UK HMRC CA3821 2011-2024 free printable template

Show details

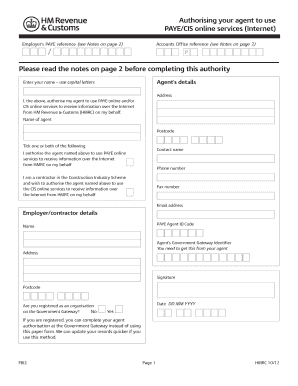

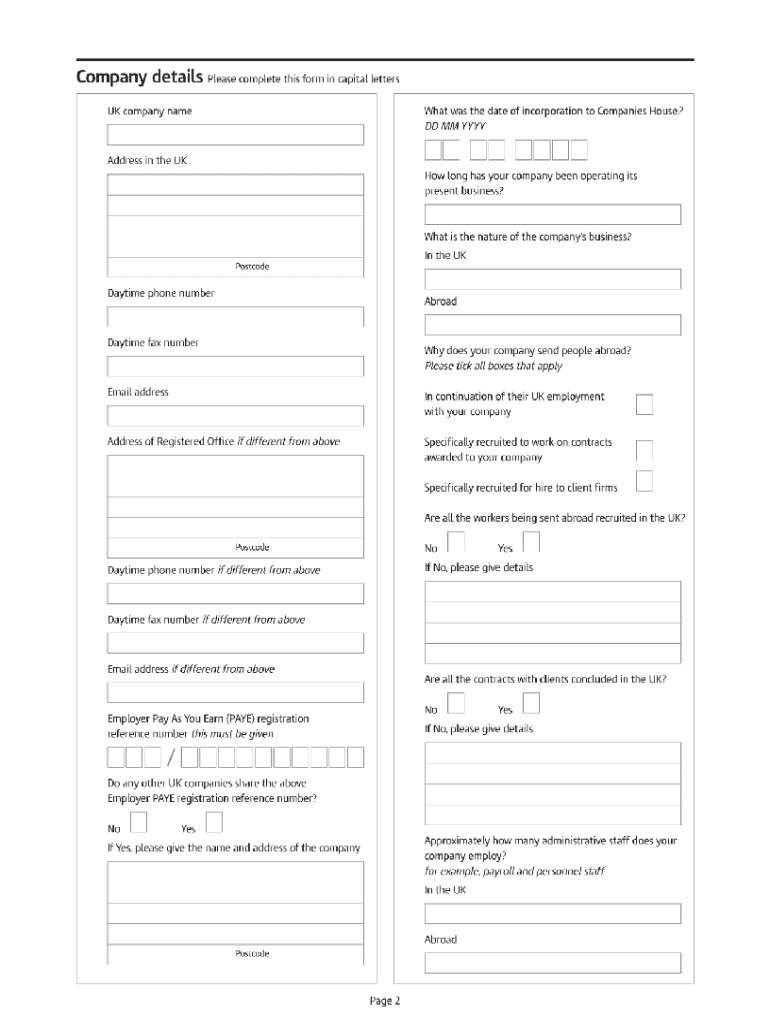

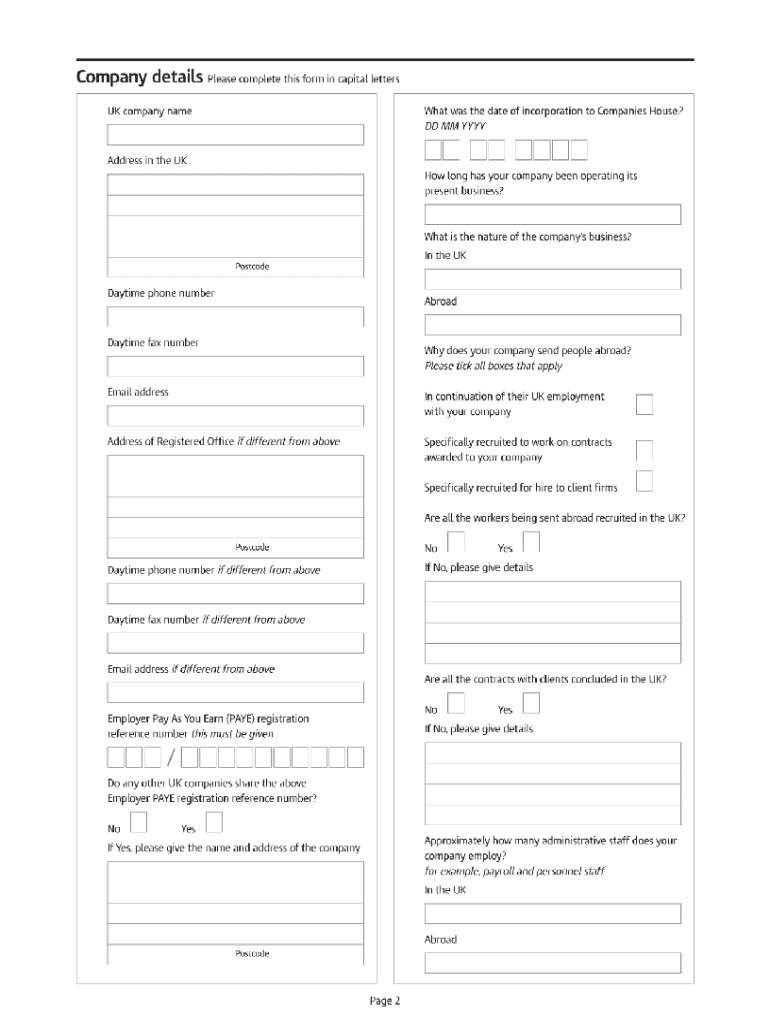

Employer's questionnaire employees working in a European Economic Area or Reciprocal Agreement country Why we are sending you this form You need to complete this form if you send employees to work

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ca3821 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ca3821 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ca3821 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ca3821 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out ca3821 form

How to fill out ca3821:

01

Start by providing your personal information such as name, address, and contact details.

02

Next, fill in the relevant tax identification numbers and other identification details required.

03

Proceed to enter your income details, including any wages, self-employment earnings, and investment income.

04

If applicable, provide information about any deductions and credits you are eligible for.

05

Finally, review the form for accuracy and sign it before submitting it to the appropriate authority.

Who needs ca3821:

01

Individuals who have earned income through employment or self-employment during the tax year.

02

Individuals who have investment income or capital gains.

03

People who are eligible for certain tax deductions and credits and want to claim them.

Video instructions and help with filling out and completing ca3821

Instructions and Help about ca3821 pdf form

Fill ca3821 form blank : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ca3821?

CA3821 is a part number for an ultra-low-power, low-noise, low-offset operational amplifier from Analog Devices. It is a rail-to-rail output device with excellent precision and accuracy.

Who is required to file ca3821?

CA 3821 is an income tax return form used by certain California residents who earned income in another state or country and must pay taxes to both the State of California and that other jurisdiction. Specifically, this form is required to be filed by any California resident who meets one of the following criteria:

1. Received income from sources outside of California that is not included on their federal return

2. Received wages from a job in another state or country

3. Received income from a business operating in another state or country

4. Received rental income from property located in another state or country

5. Received income from an estate or trust located in another state or country

6. Received income from the sale of property located in another state or country

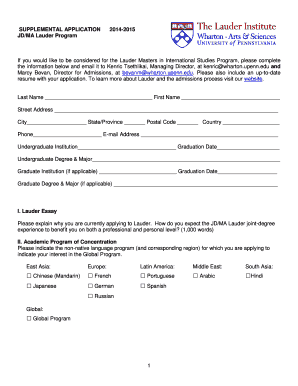

How to fill out ca3821?

CA3821 is a form used to report California gross income for nonresidents and part-year residents.

1. Enter your name, Social Security number, and the address you used when filing your federal tax return.

2. Enter your filing status and the dates you were a resident of California.

3. Enter your gross income from all sources, including wages, salaries, tips, rental income, pensions, Social Security, interest, dividends, and any other income.

4. Enter any deductions you are taking such as standard deductions, itemized deductions, and exemptions.

5. Enter your net income from all sources, including income from outside of California.

6. Calculate the total amount of taxes due by multiplying your net income by the applicable tax rate.

7. Sign and date the form.

8. Submit the completed form with your payment to the California Franchise Tax Board.

What is the purpose of ca3821?

The CA3821 is an integrated circuit (IC) designed for use in a variety of applications, such as automotive, industrial, consumer, and medical. It is a dual-channel, low-voltage, low-power, low-cost, pulse-width modulation (PWM) controller IC that can be used to control the speed and direction of motors, regulate the output power of power supplies, and control the brightness of lights.

What information must be reported on ca3821?

CA3821 is a California state tax form that must be completed and filed by employers who make payments to independent contractors. The information required on the form includes the contractor's name, address, and taxpayer identification number, the total amount paid to the contractor, and any tax withholding information. Employers must also indicate whether the contractor is exempt from state income tax withholding.

When is the deadline to file ca3821 in 2023?

The deadline to file Form CA3821 in 2023 is April 15th, 2024.

What is the penalty for the late filing of ca3821?

The penalty for the late filing of Form CA-3821 is up to 25% of the unpaid taxes, with a minimum penalty of $135 or 100% of the unpaid taxes, whichever is less.

Can I create an eSignature for the ca3821 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your ca3821 form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit ca3821 form pdf on an iOS device?

Create, edit, and share form ca3821 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete hmrc ca3821 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your ca3821 hmrc form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your ca3821 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ca3821 Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to ca3821 certificate form

Related to form ca3821 and form ca3822

If you believe that this page should be taken down, please follow our DMCA take down process

here

.